Decode the Market: Yes Bank Share Price Forecasts for Online Traders

- Posted on:

- Posted by: Brivelacce

- Posted in: Finance

For online traders, decoding Yes Bank share price forecasts is crucial for making informed investment decisions and maximizing profits. With the help of online demat accounts, traders have access to a plethora of tools and resources to analyze market trends and predict future movements in Yes Bank share price. Let’s delve into some forecasts for Yes Bank share price and how online traders can utilize their online demat account to navigate the market effectively.

Analyzing Historical Trends

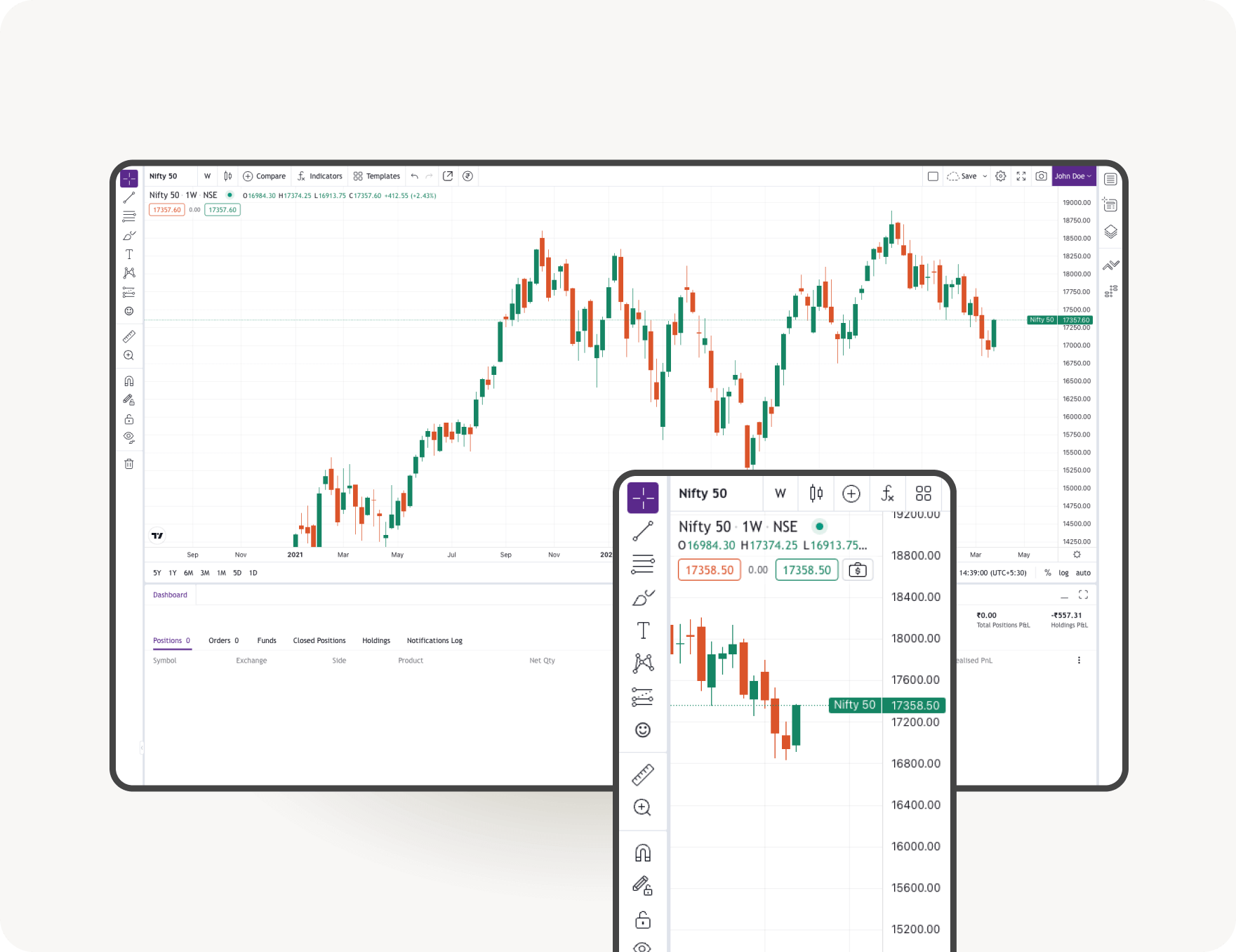

One way to forecast Yes Bank share price is by analyzing historical trends. Online demat accounts provide traders with access to historical price data, allowing them to identify patterns and trends over time. By studying past performance, traders can gain insights into potential future movements in Yes Bank share price and make educated predictions based on historical data.

Utilizing Technical Analysis Indicators

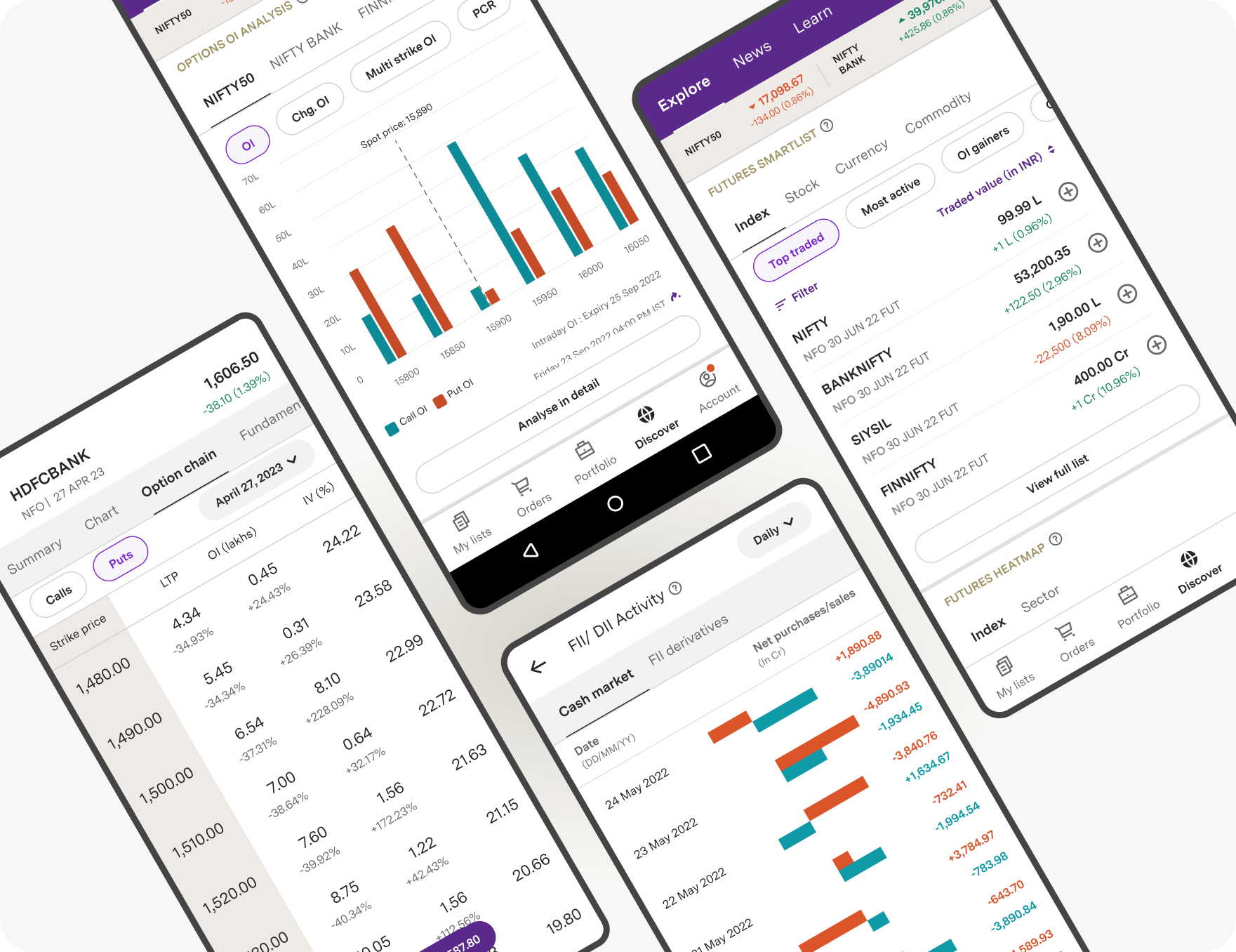

Technical analysis indicators are valuable tools for forecasting Yes Bank share price movements. Online demat accounts offer a wide range of technical analysis tools, such as moving averages, relative strength index (RSI), and Bollinger Bands, which help traders identify trends, momentum, and potential reversal points in Yes Bank share price. By utilizing these indicators, traders can make informed decisions about when to buy or sell Yes Bank shares based on technical signals.

Incorporating Fundamental Analysis

Fundamental analysis is another approach to forecasting Yes Bank share price. This involves evaluating the underlying factors that influence the intrinsic value of Yes Bank shares, such as financial performance, industry trends, and macroeconomic factors. Online demat accounts provide access to fundamental data, including earnings reports, balance sheets, and economic indicators, which traders can use to assess the long-term prospects of Yes Bank and make predictions about its future share price.

Monitoring Market Sentiment

Market sentiment plays a significant role in driving Yes Bank share price movements. Online traders can gauge market sentiment through various sources, such as news headlines, social media trends, and analyst reports, all of which are accessible through online demat accounts. By monitoring market sentiment, traders can anticipate shifts in investor sentiment and adjust their trading strategies accordingly to capitalize on Yes Bank share price fluctuations.

Combining Multiple Approaches

Ultimately, the most effective approach to forecasting Yes Bank share price is often a combination of different methods. By incorporating both technical and fundamental analysis, as well as monitoring market sentiment, traders can gain a more comprehensive understanding of Yes Bank share price dynamics and make more accurate predictions about its future movements. Online demat accounts provide the tools and resources needed to integrate multiple approaches seamlessly and make well-informed trading decisions.

Conclusion

In conclusion, decoding Yes Bank share price forecasts is essential for online traders looking to navigate the market successfully. By utilizing their online demat accounts to analyze historical trends, utilize technical analysis indicators, incorporate fundamental analysis, monitor market sentiment, and combine multiple approaches, traders can make informed predictions about Yes Bank share price movements and position themselves for success in the market. With the right tools and strategies at their disposal, online traders can decode the market effectively and achieve their financial goals with Yes Bank shares.

Are you ready to take control of your finances and make smart financial decisions? Look no further! In this comprehensive..

When building wealth, compounding interest is one of the most powerful tools at your disposal. Compounding interest is the process..

Exchange-traded funds (ETFs) are affordable, transparent, and simple. The fact that they tick so many boxes is one of the..

Consumer loans are a great way to have money sent directly to you in a short time. Generally, they have..